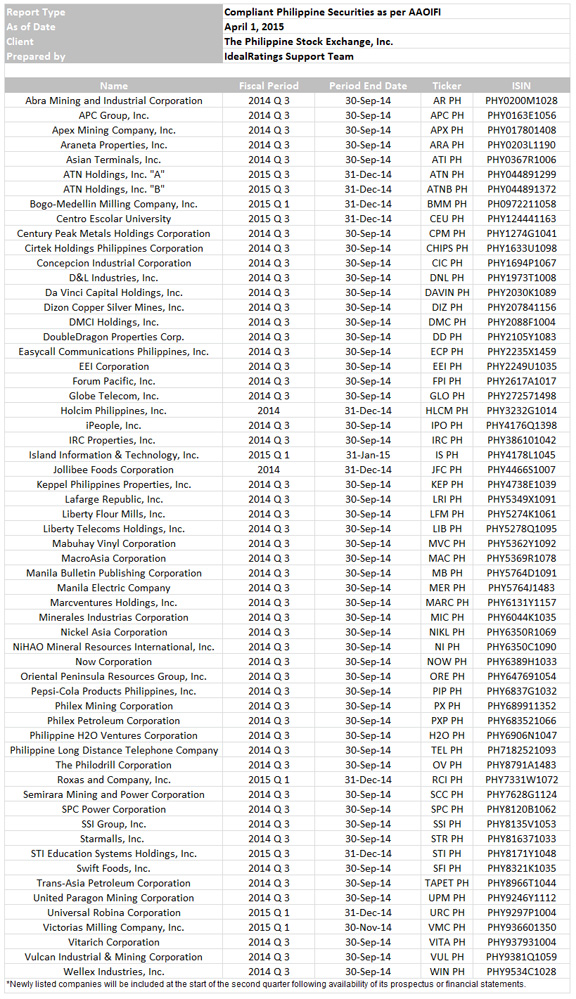

MANILA, PHILIPPINES – The Philippine Stock Exchange has released the updated list of Shariah-compliant securities listed in the local bourse.

The list was based on the quarterly screening of its PSE securities for Shariah compliance for the period January to March 2015.

It engaged the services of IdealRatings, Inc, a provider of Islamic finance information, to screen listed companies in accordance with the standards for Shari’ah compliance as stipulated by the Accounting and Auditing Organization for Islamic Finance Institutions (AAOFI).

“We update our PSE Guidelines on Screening of Securities for Shari’ah Compliance to further align our screening methodology with AAOIFI standards,” the PSE said in a statement posted on its website.

To qualify, listed companies are required to meet the criteria stated in the PSE Guidelines on Screening of Securities for Shari’ah Compliance.

The criteria stated that a company’s primary businessshould not be any of the prohibited activities and the total revenues derived by the company from the prohibited businesses must not exceed 5 percent of its gross revenues.

Among the prohibited activities identified are conventional interest-based lending, financial institutions, insurance, mortgage and lease, derivatives, pork, alcohol, tobacco, arms and weapons, embryonic stem-cell research, hotel, gambling, casinos, music, cinema and adult entertainment.

The criteria also said that interest-bearing debt should not exceed 30 percent against the 12-month trailing average market capitalization of the company.

Also included as criteria is the total amount of interest-bearing deposits or investments that should not exceed 20 percent against the 12-month training average market capitalization of the company.

Accounts receivables should also not exceed 67 percent against the 12-month trailing average market capitalization of the company.

The Shari’ah compliant listed companies for the current review period are the following:

– BusinessNewsAsia.com