Malaysia’s CIMB Group Holdings, the country’s second-largest lender, has received a banking license from Vietnamese regulators, allowing it to operate a 100-percent-owned banking business for 99 years.

In a disclosure to Bursa Malaysia, CIMB Group said its subsidiary CIMB Bank is now allowed to establish and operate a subsidiary in Vietnam after receiving the operating license from Vietnam’s central bank, the State Bank of Vietnam.

The group said it will now embark on its plans to set up operations in Vietnam to offer a comprehensive range of corporate, commercial and consumer products services.

CIMB Group expects its first branch in Hanoi to be fully operational by the end of 2016.

Read Also: CIMB’s Net Profit Falls 32.6 Percent in Q2 2015

The operating license granted to CIMB has a validity of 99 years starting this month. The license allows CIMB to operate a bank with a MYR584.9 billion (USD144 million) registered capital.

When fully operational, CIMB’s Vietnam unit will be the seventh fully foreign-owned bank in the country.

Last year, CIMB Group chief executive Tengku Datuk Seri Zafrul Aziz said the group’s foray in Vietnam will be able to further solidify its position as the leading Asean bank and offer the much needed regional connectivity to intermediate trade and investment flows.

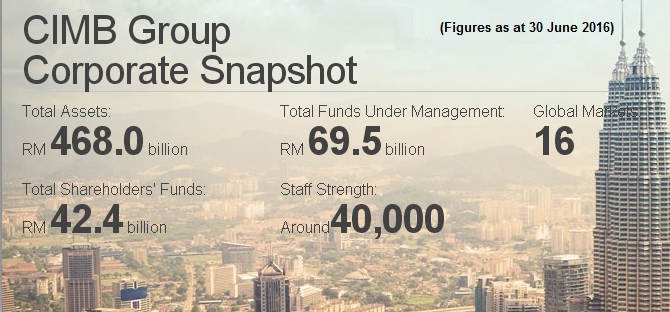

CIMB Group First Half Financial Report

CIMB Group Holdings earlier reported a profit before tax of MYR2.312 billion for the first half of 2016. On a year-on-year (Y-o-Y) basis, the net profit of MYR1.687 billion improved 1.7% compared to the Business As Usual (“BAU”) 1H15 Net Profit of MYR1.659 billion.

The 1H16 net earnings per share (“EPS”) stood at 19.6 sen, while the annualised 1H16 net return on average equity (“ROE”) was 8.1%. The Group declared a first interim net dividend of 8.00 sen per share to be paid via cash or an optional Dividend Reinvestment Scheme (“DRS”).

Read Also: Bursa Malaysia Notes Unusual Market Activity of Sapura Resources, Ge-Shen Corp Stocks

The total interim dividend amounts to a net payment of RM698 million, translating to a dividend payout ratio of 41.4% of 1H16 profits. The Group had announced a special interim dividend-in-specie equivalent to 2.00 sen per share involving the distribution of CIMB Niaga B Shares to CIMB Group shareholders on a ratio of 1 CIMB Niaga share for approximately every 6.39 CIMB Group shares. – BusinessNewsAsia.com