First-in-Market Product with Unlimited(1) Coverage on Major Critical Illnesses

HONG KONG – (ACN Newswire) – Generali Life (Hong Kong) Limited (“Generali Life”) has launched a game-changing critical illness product, “LionGuardian” (the “Plan”), the first product in the market to offer whole life protection with unlimited(1) major critical illness benefits. The Plan also provides high levels of protection for benign tumours, congenital child illnesses and common mental health conditions. The debut of LionGuardian comes at a time when rates of critical illnesses like cancer, heart attack and stroke are on the rise, with an increasing risk of striking younger people. LionGuardian provides comprehensive coverage of 138 different illnesses offering 100% of the Sum Assured for each Major Critical Illness Claim without affecting other benefit payouts. The Plan is unique in the Hong Kong market and has set a new benchmark for other products.

Cillin O’Flynn, CEO of Generali Life (Hong Kong) Limited, said of the Plan, “Generali has been operating in Hong Kong for over 40 years and we have been steadfastly committed to bringing the best offerings to the people here. LionGuardian delivers on Generali’s promise to be a lifetime partner to our customers. We have leveraged our knowledge and expertise to launch a ‘Critical Illness” first delivering comprehensive protection in a straightforward way to our policyholders.”

LionGuardian: Six Promises of Comprehensive Protection

The Plan offers peace-of-mind to customers by providing comprehensive protection against lifelong recurring risks of critical illnesses. The Plan makes six promises for policyholders. These are:

1. Unlimited(1) coverage on major critical illnesses

2. Every claim of major critical illness benefit will be equal to 100% of the sum assured

3. Future premium waived after 100% of the sum assured is paid

4. Protection against 138 different illnesses

5. Protection for the mental health of children and coverage for congenital conditions

6. Protection for benign tumours

Two Trailblazing Features Unique to the Market

Unlimited Protection for Major Critical Illnesses

The LionGuardian Plan is a first-of-its-kind policy which offers unlimited(1) protection for major critical illnesses for health risks including cancer, stroke and heart attack with coverage of the insured up to 100 years of age. The protection is “unlimited”(1) in the sense that customers can file claims an unlimited number of times and the total amount of benefits paid will remain unlimited over the course of the insured’s lifetime.

Future Claims Unaffected by Early Stage or Minor Illnesses Claims

Generali understands the concerns of policyholders about the impact of debilitating illnesses on their finances and believes that every claim of Major Critical Illness Benefit is equally important. Unlike existing products which often discount Major Critical Illness Benefits claims by the amount of previous claims made on early stage benefits, the amount of benefits for the insured under LionGuardian for major illnesses will not be affected by previous claims, and the benefit resulting from every claim of major critical illnesses will be equal to 100% of the sum assured. This advantage is possible through another design in which Early Stage or Minor Illnesses Benefits are under a standalone coverage provision that has no impact on Major Critical Illness Benefits and Death Benefits. The benefit coverage is equal to 20% of the sum assured upon diagnosis. The Plan also waives payment of all future premiums after 100% of the sum assured is paid.

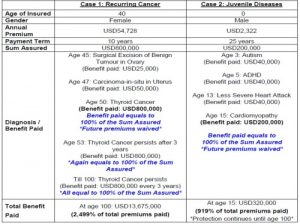

The following sample cases illustrate some of the key features unique to LionGuardian:

https://www.acnnewswire.com/topimg/Low_Englishtable20190214.jpg

Case 1: Recurring Cancer

Age of Insured : 40

Gender: Female

Annual Premium: USD54,728

Payment Term: 10 years

Sum Assured: USD800,000

Diagnosis / Benefit Paid:

Age 45: Surgical Excision of Benign Tumour in Ovary (Benefit paid: USD25,000)

Age 47: Carcinoma-in-situ in Uterus (Benefit paid: USD50,000)

Age 50: Thyroid Cancer (Benefit paid: USD800,000)

Benefit paid equals to 100% of the Sum Assured

*Future premiums waived*

Age 53: Thyroid Cancer persists after 3 years (Benefit paid: USD800,000)

*Again equals to 100% of the Sum Assured*

Till 100: Thyroid Cancer persists (Benefit paid: USD800,000 every 3 years)

*All equal to 100% of the Sum Assured*

Total Benefit Paid: At age 100: USD13,675,000 (2,499% of total premiums paid)

Case 2: Juvenile Diseases

Age of Insured: 0

Gender: Male

Annual Premium: USD2,322

Payment Term: 25 years

Sum Assured: USD200,000

Diagnosis / Benefit Paid:

Age 3: Autism (Benefit paid: USD40,000)

Age 5: ADHD (Benefit paid: USD40,000)

Age 13: Less Severe Heart Attack (Benefit paid: USD40,000)

Age 15: Cardiomyopathy (Benefit paid: USD200,000)

Benefit paid equals to 100% of the Sum Assured

*Future premiums waived*

Total Benefit Paid: At age 15: USD320,000 (919% of total premiums paid)

*Protection continues until age 100*

The above case illustrations assume an annual payment of the premium

Cillin O’Flynn added, “At Generali, we pride ourselves on being a customer-centric insurance provider, and we believe that attentively servicing our brokers and customers with a genuine personal touch is what sets us apart from our peers. The LionGuardian Plan is a market-first innovation that reinforces our commitment to develop competitive insurance and to exceed the expectations of our customers in Hong Kong. As our business continues to grow in Hong Kong, we will strive to put our customers at the centre of everything we do and introduce more innovative insurance solutions to protect them”.

Important notes:

– The information contained in this document is intended as a general summary of information for reference only. For details of coverage, please refer to the relevant insurance policy documents, e.g. illustration and product brochure (https://generali-prd.s3-ap-southeast-1.amazonaws.com/LionGuardian_TCEN_1.pdf) of LionGuardian.

– For further details, please contact Generali Life (Hong Kong)’s Customer Service Hotline on +852 3187 6858.

– This document is for distribution in Hong Kong only. It is not an offer to sell or solicitation to buy or provision of any insurance product outside Hong Kong.

Notes:

(1)Subject to terms and conditions. For details, please refer to the product brochure.( https://generali-prd.s3-ap-southeast-1.amazonaws.com/LionGuardian_TCEN_1.pdf)

About Generali Hong Kong

Our Generali entities in Hong Kong have been providing comprehensive insurance and investment protection to individuals and organizations since the 1970s. Over the years, we have come to understand the individual requirements of our customers, and are continuously adapting and innovating to meet their changing needs.

We offer a wide range of insurance solutions from life and general protection to sophisticated corporate risk management and financial management products designed to enhance investment portfolios and preserve generational wealth.

About Generali Group

Our parent company, the Generali Group (Assicurazioni Generali S.p.A.) is one of the largest global insurance providers. We pride ourselves for our history of over 185 years and we are listed amongst the Fortune Global Top 60 companies with total premium income exceeding EUR68 billion in 2017. With over 71,000 employees worldwide serving 57 million customers in more than 50 countries, the Group occupies a leadership position in Western European markets and an increasingly important place in Asia and in Central and Eastern Europe.

Generali and its core subsidiaries have been reaffirmed “A” Financial Strength Rating with a Stable outlook in A.M. Best’s 2018 review. In 2017, the Group was included among the most sustainable companies in the world by the Corporate Knights ranking, and listed the world’s 50 smartest companies according to the MIT Technology Review in 2015.

Company information as at Nov 2018

Media inquiries

Jennifer Chan

Generali Life (Hong Kong) Limited

Tel: +852 3187 6102

Email: mktg.comm@generali.com.hk