JCB Co., Ltd., a major global payment brand and a leading payment card issuer and acquirer in Japan, has signed a memorandum of understanding for building a new B2B payment solution for small and mid-sized enterprises in Japan with Paystand Inc, a California-based, fintech provider of commercial payments infrastructure.

– How does the Paystand platform work?

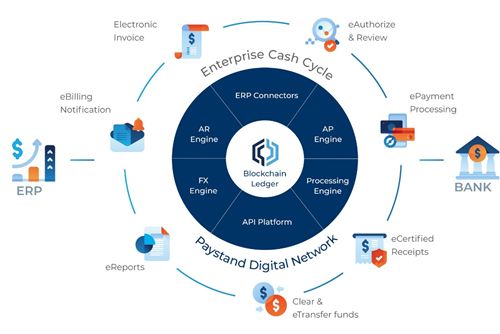

Paystand provides a SaaS-based B2B payment platform for businesses. The Paystand platform connects suppliers and payers through a frictionless payment network that speeds up time to cash, automates manual processing, and mitigates risk of fraud. Suppliers also benefit from Paystand’s zero-fee, predictable, subscription cost structure that reduces transaction costs and improves forecasting and margins. The Paystand platform gives payers the ease of instantaneous bank to bank transfers with real-time fund verification, but also supports more traditional payment methods, including credit and debit cards and ACH. Paystand integrates seamlessly into ERP systems such as Oracle Netsuite and extends payment automation technology directly into those Systems of Record. Today, more than 150,000 businesses use Paystand every day for their most critical B2B payments.

– Collaboration with Paystand & benefits to JCB’s enterprise customers

JCB and Paystand seek to deliver a fully automated and digitalized B2B payment solution in the Japan market. With regards to the introduction of a new consumption tax rate in Japan, the Qualified Invoicing System will be also launched effective 1 October 2023. By this new rule, Japanese enterprises as taxpayers are required to include more detailed information including registration numbers and applicable tax rates in their invoices and books in order to become eligible for crediting of input consumer tax. JCB and Paystand consider the new payment solution will help Japanese enterprises to comply with such stricter requirements and drive more digitalization and cashless payment in the B2B payment market.

About Paystand

Paystand is one of the fastest growing commercial payment platforms for mid-size and enterprise companies. Through its Payments-as-a-Service model and blockchain-based technology, Paystand helps businesses digitize and automate the entire cash cycle. Today, companies use Paystand’s to drive greater capital efficiency, streamline back-office operations, and enable best-in-class payment experiences. Paystand has been consistently recognized as one of the top innovators in enterprise financial services and is backed by Blue Run Ventures, Cervin Ventures, and LEAP Global Ventures. The company operates in the United States, Canada, and Mexico, and is expanding strategically to Europe, and Asian markets including Japan. For more information: https://www.paystand.com/.

(1) Name: Paystand Inc

(2) Location: 1800 Green Hills Road, Suite 110, Scotts Valley, CA 95066

(3) Position and name of representative: CEO and Co-Founder Jeremy Almond

(4) Description of business: Blockchain-based B2B billing and payments service

(5) Established: 1 March 2013

(6) Home page: https://www.paystand.com/

About JCB

JCB is a major global payment brand and a leading payment card issuer and acquirer in Japan. JCB launched its card business in Japan in 1961 and began expanding worldwide in 1981. As part of its international growth strategy, JCB has formed alliances with hundreds of leading banks and financial institutions globally to increase merchant coverage and cardmember base. As a comprehensive payment solution provider, JCB commits to provide responsive and high-quality service and products to all customers worldwide. For more information: www.global.jcb/en.

Contact:

JCB

Kumiko Kida

Corporate Communications

Tel: +81-3-5778-8353

Email: kumiko.kida@jcb.co.jp

Paystand

Mark Fisher

VP Marketing

Tel: +1-800-708-6413

Email: mfisher@paystand.com