Turnover and net profit increased at the same time, innovative pipeline continued to expand, and the synergy between its businesses became increasingly obvious …..China Medical System Limited (CMS), which has just released its annual results, has brought too many surprises to the market.

In recent years, CMS has successfully completed its transformation from an “old CMS” driven by sales and promotion to a “new CMS” driven by innovative R&D by deepening its innovative pipeline and promoting the synergistic development of multiple business lines. Now, with its strength in business development and sales promotion, the innovative pipeline and new businesses continued to expand, which has become a powerful driving force to lift the Company’s valuation ceiling.

According to zhitongcaijing.com app, on March 16, CMS released its 2020 annual results. The financial report shows that the Company’s overall performance achieved solid growth in 2020, with annual turnover up 14.4% y-o-y to RMB6.946 billion, net profit up 30.7% y-o-y to RMB2.556 billion.

In fact, the Company’s ability to grow against the odds in an environment affected by the global public health event in 2020 was made possible by the stable revenue from its existing core products. In addition, the Company has actively participated in innovation and acquired products with differentiation advantage. With the smooth progressing of registration and clinical processes for a number of its high-quality products, and the approaching of the commercial launch of its blockbuster innovative drugs, certainty for its future growth continues to improve. In addition, CMS is also expanding the healthcare business as well as the dermatology and medical aesthetic business, aimed at forming a synergistic development between the old and new business lines to bring new growth engine for the Company and promote the continuous release of intrinsic value in the future.

Behind its solid growth, lies the strength of its core products.

CMS’ overall performance relies on the Company’s strong abilities in academic promotion and retail network, and more importantly, on the strength of its core products.

According to the annual report, the Company has four core product lines: cardio-cerebrovascular line, digestion line, ophthalmology line and dermatology line. In terms of product sales, the cardio-cerebrovascular line and digestion line, the Company’s most important core product lines, continued to maintain growth in 2020, with revenue up by 18.9% and 18.5% respectively. Whilst, in the second half of the year, the ophthalmology and dermatology lines saw extremely strong revenue growth, reversing the slightly downward trend seen in the first half of the year under the impact of the pandemic, achieving revenue increases of 16.3% and 20.3%, respectively.

The key reasons for the stable growth of the Company’s core product lines are the low impact of policies and the stability of the products’ markets.

On the policy side, so far, the expansion of “centralized procurement” has no impact on CMS yet. Take Plendil and Deanxit, the Company’s heavyweight products in its cardio-cerebrovascular product line, for example, in China, no generic Plendil has passed the consistency evaluation, and there is only one generic Deanxit.

According to the current rules of “with three or more generic drugs that have passed consistency evaluation” in the selection of drugs for centralized procurement, it can be seen that national centralized procurement policy will not affect the performance of the Company in the short run.

As for the product market, many of CMS’ core products are drugs for chronic diseases with strong brand stickiness. Patients often need long-term or lifelong medication with low product replacement rate and low daily treatment cost. So they are not only less affected by public health events, but even if they are included in national centralized procurement in the future, the impact may be lower than the market expectation due to the product’s high retail market share and strong patient stickiness.

In fact, in addition to promoting the stable growth of its core products, CMS has also made great progress in the field of innovative R&D.

Innovative pipeline R&D continues to advance with “fresh blood” continuously injected

As a pharmaceutical company with international development capabilities, CMS has developed an innovative drug pipeline through its excellent BD capabilities and the integration of international resources, which is another important path to meet the huge unmet medical needs. Today, CMS, which has responded quickly and actively laid out its innovative pipeline, is already reaping the fruits of its innovative R&D.

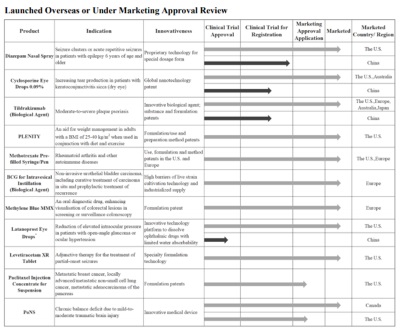

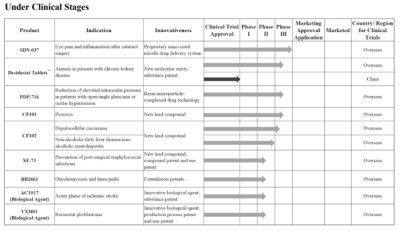

According to the data, CMS has altogether over 20 innovative drugs, all of which are innovative products with high innovation levels, good market potential and competitive differentiation advantages. Among them, 9 products have been approved for marketing in the U.S. and/or Europe, and 3 products are in the process of registration clinical trials in China.

Take the core product Diazepam Nasal Spray as an example, by the end of 2020, CMS has completed dosing and blood sample collection of all subjects in the comparative PK study, and the product is expected to be launched in China this year.

Notably, Diazepam Nasal Spray is also the first out-of-hospital emergency drug approved by the U.S. FDA for acute repetitive seizures in patients with epilepsy 6 years of age and older. If the product is successfully marketed in China, it is speculated that it will become the home remedy for children with epilepsy based on parents’ protective mindset towards their children. The market of Diazepam Nasal Spray is very promising after its launch. It is estimated that there are about 6 million active epilepsy patients in China, and about 400,000 new patients each year. Among patients who receive formal treatment, 20-30% still cannot be effectively controlled, and the number of recurrent seizures is frequent, averaging as many as nearly 70 times per year.

Assuming that 15% of the 2 million patients who receive formal treatment need Diazepam Nasal Spray to control recurrent and frequent seizures, and an average of 40 seizures attacks per person per year, the annual demand is estimated at 12 million units. Currently, the selling price of Diazepam Nasal Spray is approximately $300 per unit in the U.S., and assuming a selling price of RMB300 per unit in China, the annual sales market potential of the product would be RMB3.6 billion.

Recently, the registration bridging Phase III trial in China of Tildrakizumab, a novel monoclonal antibody specifically targeting IL-23, has completed enrollment of all 220 subjects within only 2.5 months (including holidays of the New Year and Chinese Lunar New Year), highlighting another yet-to-be-discovered innovative advantage of CMS’s rapid clinical advancement capability based upon its professional sales and promotion network as well as expert resources.

In addition to Diazepam Nasal Spray and Tildrakizumab, there are seven other products in the Company’s innovative pipeline, including Cyclosporine Eye Drops 0.09%, all of which have been approved for marketing in Europe and/or the U.S., and the Company is now actively promoting the marketing of these products in China.

In addition to advancing the research and development of the existing innovative pipeline, the Company also realized sustained expansion of the innovative pipeline in 2020.

According to zhitongcaijing.com app, in January 2020, CMS strategically cooperated with Zydus and acquired the exclusive license of innovative product Desidustat Tablets; in June, the Company made equity investment in Gelesis and acquired innovative product PLENITY; in September, the Company strategically cooperated with medac and acquired innovative products Methotrexate Pre-filled Syringe/Pen and BCG for Intravesical Instillation; in December, the Company acquired innovative product Methylene Blue MMX through strategic cooperation with Cosmo. All of the above products are introduced based on the actual needs of the Chinese market, and the market space of each product is at least RMB one to several billion.

In terms of the Company’s development plan, in the short term of about 3 years, CMS will have 6-7 blockbuster innovative drugs marketed in China, with a market potential totaling over RMB 20 billion. The Company expects to introduce at least 5 innovative drugs per year on average and is expected to become one of the Chinese pharmaceutical companies with the most innovative drugs in the long term.

High-quality innovative drugs with huge market demand, combined with strong drug commercialization and academic promotion capabilities, will be a big boost to the Company’s revenue and profits in the short- to mid-term once these innovative drugs are approved for marketing in China.

Deep plowing the healthcare industry to create trending healthcare products through industrial synergy

In 2020, with the growing demand for healthcare, driven by policy, Internet technology and the impact of COVID-19, the healthcare industry in China is facing a great window for development, which also brings new development opportunities for CMS.

CMS’s rich overseas channel resources and good reputation, mature product introduction system, responsive international supply chain system and strong sales promotion network have formed a significant industrial synergy with the healthcare segment, supporting the healthcare segment to continuously create “best-selling” products and establish strong market advantages.

According to zhitongcaijing.com app, CMS has cooperated with major e-commerce platforms to open cross-border e-commerce “CMS Health Overseas Flagship Stores” to create a one-stop shopping platform for high-quality overseas healthcare products.

On November 1 last year, CMS Health Overseas Flagship Stores were launched in JD Worldwide and Youzan Mall; by the end of last year, 18 products from 4 well-known European brands had been launched. It is expected that by the end of 2021, the flagship stores will have more than 300 cooperative products, covering nine core areas.

In addition, CMS is continuously injecting new energy into its healthcare business. It is reported that as of press date, its flagship store has nearly 60 products, the surprisingly rapid development of the business clearly shows the extremely strong execution of CMS.

Diving deep into the golden track of dermatology and medical aesthetics, CMS continues to strengthen its ability to integrate upstream and downstream industry chain

In addition to the healthcare business, the dermatology and medical aesthetic business is also a key area for CMS to develop vigorously. CMS has been involved in skin treatment and has established certain expert network resources. In order to further enter the medical aesthetic product line and achieve deeper development in skin management and medical aesthetics, on February 1 this year, CMS completed the acquisition of Luqa, a dermatology and medical aesthetics specialty company, to go further into the golden track of medical aesthetics.

Luqa’s key prescription medicines and medical devices cover Aethoxysklerol, Stratamark/Strataderm, and Zalain, and Aethoxysklerol is one of the leading brands that has long been clinically used for the sclerotherapy of varicose veins; Luqa’s medical aesthetic products feature Mesohyal and Mesoeclat from Mesoestetic of Spain, and Neauvia hyaluronic acid series.

CMS’ acquisition of Luqa is noted by the market because of the strong synergy effect between upstream and downstream industries.

From the upstream of the industry chain, Luqa has rich leading European medical aesthetic resources, while CMS has more than 20 years of experience, resources and channels of investment in products in overseas markets, and has a good reputation overseas, especially in Europe, the acquisition to achieve the interchange of resources in the upstream of the industry line, which will undoubtedly promote the integration and fission of resources more effectively and achieve the effect of “1+1>2”. With the addition of Luqa, it is expected that more leading skin management and medical aesthetic products will be included, enriching CMS’ product lineup and expanding the area of its business.

In the downstream part of the industry chain, CMS has rich resources of dermatology experts, who will be able to give advice, build brand and create reputation for dermatology and medical aesthetic products from a professional perspective, while Luqa’s sales channels covering a wide range of medical institutions and agency network will complement CMS’s advantages and help CMS to form a more comprehensive and in-depth downstream network layout in the future.

In terms of the overall medical aesthetic market, China’s medical aesthetic industry grew at a CAGR of 22.5% from 2014-2019, which made China one of the fastest-growing countries in the world and is expected to maintain a high growth rate of over 20% in the coming years. In the growing dermatology and medical aesthetic market, there is not yet a leading company in China. The resource synergy between Luqa and CMS will help CMS to have strong competitive advantages in both product and sales. With these advantages, CMS is expected to become the first high-end beauty and health management company in China.

However, the market has not yet reasonably valuated CMS, who has strong innovative R&D strength and multi-industry synergy.

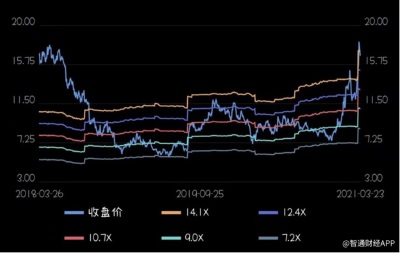

According to zhitongcaijing.com app, although the valuation of CMS has increased recently due to strong performance, the dynamic PE reflected by the Company’s share price is only about 12.34x as of the press date. While the already undervalued pharmaceutical and healthcare stocks in the Hong Kong Stock Exchange are still trading at the PE of nearly 20x, which verified that CMS is obviously undervalued.

In fact, there is a certain lag in the market for the valuation of CMS. From the perspective of business development, it is not only the existing drugs that are currently driving the Company’s valuation growth, but also the Company’s innovative pipeline, healthcare business and dermatology and medical aesthetic business, which are all immune to China’s “centralized procurement” and will bring strong performance momentum to the Company in the future, and are also powerful engines to drive the Company’s valuation growth.

From the perspective of innovative drug development alone, as mentioned earlier, CMS will have 6-7 blockbuster new drugs marketed in China in 1-3 years, with a combined annual market potential of over RMB 20 billion. According to an institution’s previous estimation, the target price will raise to HK$19.80 using the PE valuation method, based on a conservative estimate of the value of seven blockbuster innovative products, as well as the value of seven generic drugs and without considering the value of the Company’s healthcare business and Luqa’s brand value for the time being.

zhitongcaijing.com app observed that on March 18, the share price of CMS jumped 15.01% to close at HK$18.24 per share. It can be seen that the market’s attitude towards the “new CMS” has started to improve significantly. Taking into account the positive impact of the healthcare and dermatology and medical aesthetic segment, CMS is expected to see further valuation growth in the mid to long term.

In the dermatology and medical aesthetic sector, for example, in China’s A-share, the average valuation of stocks under the Choice medical aesthetic concept stock has exceeded 140 times. As a scarce quality target in the concept of dermatology and medical aesthetic in the Hong Kong Stock Exchange, after the acquisition of Luqa, CMS has the conditions and advantages for its entry into the medical aesthetic industry through the great synergy in skin management and medical aesthetic field, and the Company’s valuation is also expected to rise accordingly.

According to zhitongcaijing.com app, Citi has recently released a research report, raising the target price of CMS by 134% to HK$26 from HK$11.1, with a “buy” rating.

By: zhitongcaijing.com app