- Revenue jumps 62% to S$152.3 million for 9M2021, and 48% to S$57.7 million for 3Q2021

- Rewards shareholders with proposed interim dividend of 1.0 Singapore cent per ordinary share for 3Q2021; total dividends of 3.0 Singapore cents per ordinary share for 9M2021 with dividend yield of 5.4%[1]

- Steady growth in core dental and medical clinics segment

- Progress in Acumen Diagnostics with pipeline of new PCR tests for infectious diseases, sepsis and cancer in addition to Covid-19 testing

Q&M Dental Group (Singapore) Limited (Q&M or together with its subsidiaries, the Group), a leading private dental healthcare group in Asia, today reported net profit after tax attributable to shareholders of S$27.3 million for the nine months ended 30 September 2021 (“9M2021”), and net profit after tax attributable to shareholders S$9.5 million for the three months ended 30 September 2021 (“3Q2021”).

Quarterly Financial Performance since 4Q2019

The Group has grown stronger compared to the pre-Covid-19 period. The Group’s revenue rose by 58% from S$36.5 million in 4Q2019 to S$57.7 million in 3Q2021, or 6.78% quarterly compounded growth from 4Q2019 to 3Q2021. Profit before tax grew 112% from S$7.9 million in 4Q2019 to S$16.7 million in 3Q2021, or 11% quarterly compounded growth from 4Q2019 to 3Q2021.

Dr Ng Chin Siau, Chief Executive Officer of Q&M added, “The Group’s strong financial performance and accomplishments continue to be propelled by our corporate values and philosophy of “Improving Oneself & Unity”. We believe that every individual within Q&M strives for continual improvement, and seeks knowledge and excellence in all their endeavours, and this has enabled the Group to attain sustainable growth.”

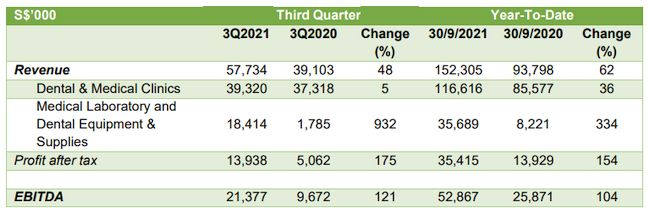

For the 9M2021, revenue contribution from dental and medical clinics increased by 36% to S$116.6 million. Revenue contribution from medical laboratory and dental equipment & supplies segment surged by 334% to S$35.7 million. The Group’s EBITDA also increased 104% to S$52.9 million, from S$25.9 million in the previous period. Earnings per share increased to 2.89 Singapore cents, from 1.46 Singapore cents in the previous period.

The Group’s net profit after tax increased by 154% to S$35.4 million from S$13.9 million in the previous period. Profit after tax attributable to owners of the parent grew by 98% to S$27.3 million, from S$13.8 million in the previous period.

For 3Q2021, revenue contribution from dental and medical clinics increased to S$39.3 million and contribution from medical laboratory and dental equipment & supplies segment also soared 932% to S$18.4 million, due to the same reasons stated above. EBITDA also increased to S$21.4 million, up by 121% from the previous period. The Group’s net profit after tax increased by 175% to S$13.9 million, from S$5.1 million in the previous period. Profit after tax attributable to owners of the parent grew by 69% to S$9.5 million, from S$5.6 million in the previous period.

As at 30 September 2021, the Group financial position remains strong with net assets of S$121.5 million with cash and cash equivalents of S$49.6 million. Bank borrowings and finance leases amounted to S$83.8 million.

Dividend

The Group proposes an interim dividend of 1.0 Singapore cent per ordinary share for 3Q2021. Earlier in the year, the Group paid 1.0 Singapore cent in 1Q2021 and 1.0 Singapore cent in 2Q2021. The 3Q2021 dividends declared, will be paid to all shareholders on 3rd December 2021.

Growth & Expansion In Operations

As at 30 September 2021, the Group’s number of dental clinics in Singapore has grown to 90, from 81 as at 30 September 2020. Similarly in Malaysia, the number of dental clinics has increased to 38, as compared to 33 previously. In order to support this growth, the Group has also increased its total number of dentists to 270 as at 30 September 2021, as compared to 250 previously.

Most recently in 3Q2021, the Company opened 3 new clinics in Singapore, in Canberra, Bedok Reservoir and IMM shopping mall.

The Group also continues to focus on its investments in opportunities in allied sectors, with its Associated Company, Aoxin Q&M Dental Group Limited (“Aoxin”)’s recent acquisition of 49% shareholding of Acumen Diagnostics Pte. Ltd. (“Acumen Diagnostics”), which raised Q&M’s effective interest in Acumen Diagnostics from 51% to 67%. With 3 scientists and 21 technicians, Acumen Diagnostics’ technical capabilities and infrastructure in molecular diagnostics, spans research and development, manufacturing, and clinical laboratory testing.

Outlook & Further Expansion Plans

Barring any unforeseen circumstances and any worsening of the Covid-19 situation, which may necessitate reimposing curbs on economic activity, the Group is optimistic on its business outlook and prospects moving forward.

For Acumen Diagnostics, the Group will continue to offer Covid-19 testing by PCR for patients that require PCR test results and for travellers as Singapore opens its borders, as well as distribute Covid- 19 antigen rapid tests (ART). The Group will also develop a panel of new PCR tests in infectious diseases, sepsis and cancer.

[1] Based on closing share price of 55.5 cents as at 9 November 2021

About Q&M Dental Group (Singapore) Limited (QC7.SI) www.QandMDental.com.sg

Q&M Dental Group (Singapore) Limited (“Q&M” or together with its subsidiaries, the “Group”) is a leading private dental healthcare group in Asia. The Group owns the largest network of private dental outlets in Singapore, operating 90 dental outlets across the country. Underpinned by about 270 experienced dentists, 7 doctors and more than 350 supporting staff, the Group sees an average of 40,000 patient visits a month in Singapore. The Group also operates 5 medical clinics and a dental supplies and equipment distribution company.

Outside of Singapore, the Group has 38 dental clinics and a dental supplies and equipment distribution company in Malaysia, as well as a dental clinic in the People’s Republic of China (“PRC”). Q&M is also the substantial shareholder of Aoxin Q&M Dental Group Limited, a dental Group listed on the Catalist board of the Singapore Exchange, which operates dental clinics and hospitals primarily in the North- eastern region of the PRC. The Group aims to expand its operations geographically and vertically through the value chain in Malaysia, the PRC and within ASEAN.

In 2018, the Group made inroads into the development of advanced technology in healthcare with the establishment of EM2AI Pte. Ltd. (“EM2AI”, formerly known as Q&M Dental AI Pte. Ltd.). EM2AI focuses on developing an Artificial Intelligence (AI) ethical enhanced guided treatment plan.

In 2019, the Group expanded into dental postgraduate education with the establishment of the Q&M College of Dentistry. It offers Singapore’s first private postgraduate diploma programme in clinical dentistry.

In 2020, the Group also expanded into the medical laboratories and research industry with the incorporation of Acumen Diagnostics Pte. Ltd. (“Acumen Diagnostics”). Acumen Diagnostics currently focuses on the manufacture, sale and distribution of COVID-19 diagnostic test kits, as well as COVID- 19 testing.

The Group was listed on the Mainboard of the Singapore Exchange Securities Trading Limited (“SGX- ST”) on 26 November 2009.

This release can be found at https://bit.ly/3FlndVF

For more information, please contact:

Waterbrooks Consultants Pte Ltd

Tel: +65 6958 8008 M: +65 9690-4959 email: query@waterbrooks.com.sg

Wayne Koo – wayne.koo@waterbrooks.com.sg M +65 933 88166

Derek Yeo – derek@waterbrooks.com.sg