WeWork, a company once valued at US$47 billion, has filed for bankruptcy in the U.S.. While such high-profile situations can potentially cast a shadow over the industry’s outlook, we at The Executive Centre (TEC) maintain our confidence that premium, innovative flexible workspace solutions continue to be in high demand.

WeWork, a company once valued at US$47 billion, has filed for bankruptcy in the U.S.. While such high-profile situations can potentially cast a shadow over the industry’s outlook, we at The Executive Centre (TEC) maintain our confidence that premium, innovative flexible workspace solutions continue to be in high demand.

Boosted by evolving corporate strategies and a renewed appreciation for workplace flexibility, the current landscape presents a fertile ground for high-quality flexible offices, tailored to the unique needs of the modern workforce.

This whitepaper aims to provide insights into the flexible workspace industry in Asia-Pacific (APAC), and to debunk the misconception of a downturn in demand, which might lead us to overlook the sector’s broader, positive growth trajectory.

The Reason WeWork Went Down

WeWork’s downfall is a classic example of overambition clashing with market realities. From a mission that pledged to ‘elevate the world’s consciousness’ to excessive expansions and mismanagement, a series of strategic missteps precipitated its collapse:

- Overexpansion without Sufficient Demand: WeWork’s rapid growth strategy was fundamentally flawed. The company expanded aggressively across the globe, opening new locations at a breakneck pace. This expansion was driven more by the desire for quick scaling rather than actual market demand. Consequently, many of their spaces remained underutilised, draining resources without generating consistent profits throughout the business’ lifespan.

- Financial Mismanagement and Governance Issues: WeWork also grappled with financial mishandling and governance problems. Its leadership faced criticism for opaque decision-making and misallocation of funds, leading to a loss of investor trust and market confidence.

The company’s failed IPO in 2019 marked a turning point, shedding light on its overvaluation and questionable governance practices. WeWork’s valuation plummeted from US$47 billion to a fraction of that, causing a major leadership overhaul and a shift in business strategy. However, the detrimental effects have already taken hold.

WeWork serves as a cautionary tale demonstrating that rapid, unchecked expansion without a demand-led strategy and solid governance can lead to significant business challenges.

Paul Salnikow, Founder and CEO of The Executive Centre said “With WeWork now in Chapter 11 and with many global commercial real estate markets in recession, any operator who is not profitable has only a slim chance of remaining in business. As hundreds of WeWork centres, along with numerous operator-run centres are closing, there has been a noticeable decrease in the capacity of low-grade coworking spaces, which gradually reduces the supply of low-grade flex space.”

“In contrast, The Executive Centre, which operates with centres in Asia, Australia, and the Middle East, has expanded its network by 60% to 200+ locations since 2019. We have done this by continuing to understand that we are a service business, focusing on delivering truly premium flex accommodation to its now 47,000+ clients.

Smart operators continue to benefit from high demand for flex workspace in APAC

Looking beyond WeWork’s woes, the demand for flexible office and coworking spaces has never been higher, powered by post-pandemic hybrid working models, and companies’ need to be fully flexible in their commercial real estate commitments.

Companies across APAC are increasingly adopting hybrid work models, with a growing trend among large corporations to incorporate flex spaces into their workplace strategies. This shift is driven by the desire to reduce fixed asset obligations and provide employees with diverse, stimulating environments. Flexible workspaces, with their scalable, plug-and-play office setups, offer the ideal solution.

Certain regions within APAC demonstrate particularly strong demand for flex spaces, including major business hubs like Singapore, Seoul, Shanghai, Tokyo, Dubai, and several cities in India, where a mix of local and international businesses drives the market.

Furthermore, despite the hybrid working pattern, the culture of physical presence in Asian offices is significantly higher than its Western counterparts. With major companies increasingly requiring employees to return to the office, these factors underscore that the demand for flex spaces in APAC is more prominent than ever before.

Recipe for success

TEC stands out as the leading premium flexible workspace operator in APAC, distinguished by its strategic focus on high-end products and services, prime locations in core CBD buildings, exceptional occupancy rates, and sustained profitability.

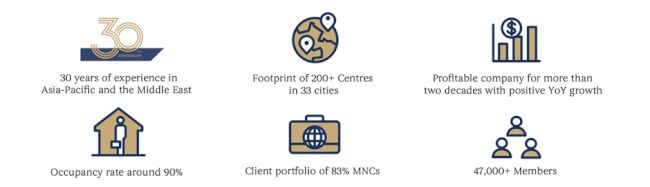

TEC demonstrates a marked difference with its growth strategy driven by pre-identified client demand, contrary to WeWork. In 2023 alone, TEC has added a total of 29 new Centres totaling 474,000 sq ft of net area and over 7,200 workstations, due to MNCs’ robust demand for TEC’s premium offerings. With close to 30 years of expertise and a solid track record in the flexible workspace market in Asia, TEC maintains an exceptional occupancy rate of around 90%.

TEC’s success is built on a deep understanding of the needs of its upscale clientele, with 83% being MNCs. It has also been a profitable company for more than two decades with uninterrupted positive year-on-year growth. TEC’s focus on profitability is evident in its operational efficiency and demand-led expansion strategies. Unlike other players in the market who pursued growth at the expense of profits, TEC has balanced its expansion with financial sustainability, ensuring long-term success in the competitive flexible workspace arena.

Conclusion

The APAC flex market presents a landscape with robust opportunities, despite the cautionary tale of WeWork. The key to success lies in understanding market dynamics, pursuing expansions driven by client demand, focusing on profitability and business sustainability, and maintaining financial prudence.

The flexible workspace industry shows significant long-term potential, and operators with strong foothold in the sector, such as The Executive Centre, will only grow stronger.

For more information about The Executive Centre, please visit www.executivecentre.com