Safekeeping of cryptocurrencies presents a challenge for institutions holding cryptocurrencies on their clients’ behalf. Cryptocurrency transactions are irreversible and anyone with full access to a wallet’s private key controls the cryptocurrencies that reside within it. Frighteningly, a number of institutional participants and even some large cryptocurrency exchanges rely on subpar custody approaches, leading Opimas to estimate that over US$190 billion worth of Bitcoin is currently at risk due to subpar safekeeping.

Figure 1: Custody Methods Utilized by Institutional Investors

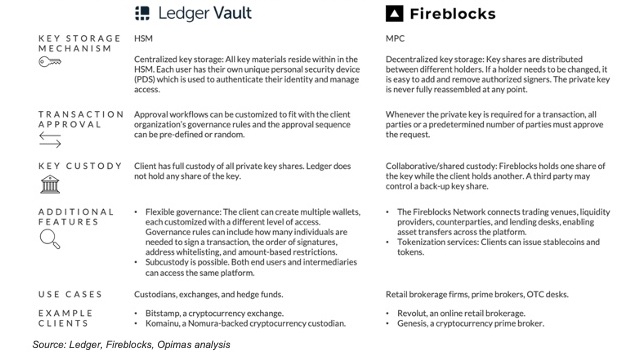

Figure 2: A Comparison of HSM and MPC Technology Providers

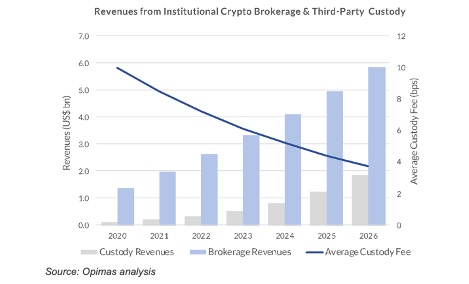

Figure 3: The Market for Crypto Custody & Prime Brokerage Services Is Growing

Figure 4: Institutional Cryptocurrency Holdings Over Time

Luckily, a number of companies have emerged to address this problem. A new research report from Opimas–Crypto Custody: No More Excuses (http://www.opimas.com/research/653/detail/), authored by analysts Suzannah Balluffi and Anne-Laure Foubert–looks at the landscape of cryptocurrency custody-enabling technology providers and institutional-grade cryptocurrency custodians as well as the size of the market for cryptocurrency custody and brokerage services.

Some key findings in the report include:

Many of even the largest holders of Bitcoin and other digital assets continue to rely on storage devices meant for individual investors. Although some of these self-custody devices and wallets are secure and reputable, the operational risk posed by this approach is significant for institutional investors. Furthermore, a chunk of institutionals’ cryptocurrency holdings sit in hot wallets on exchanges. In total, about 22% of institutional cryptocurrency holdings are safeguarded in these relatively risky manners (Figure 1).

There are no more excuses for lackadaisical safekeeping – institutions can now choose from several reputable cryptocurrency custody-enabling technology providers and institutional-grade cryptocurrency custodians. Yet no custody solution is equal – there is still no best practice when it comes to security and governance relating to private keys. For example, some providers may rely on time-tested Hardware Security Modules (HSMs), while others use a newer technology known as Multi-Party Computation (MPC) – see Figure 2.

Some cryptocurrency custodians have followed in the footsteps of traditional capital markets by adding prime brokerage services to their offerings, including trading and settlement, lending, margin finance, staking, reporting, and capital introduction services. Opimas estimates that the current annual revenues generated by the institutional crypto brokerage and custody market are roughly US$2 billion and will grow to nearly US$8 billion by 2026 – a sizeable portion of this coming from brokerage services (Figure 3).

Regulations surrounding institutions’ ability to store cryptocurrency have become clearer (and in some cases more favorable) in numerous jurisdictions. Notably, the Office of the Comptroller of the Currency (OCC) ruling in the US has allowed banks to store cryptocurrencies for their customers. This regulatory clarity has led a number of financial institutions around the world to provide trading and custody for digital assets. With the advances in brokerage and custody solutions, Opimas expects institutional cryptocurrency holdings to grow from 20% of the cryptocurrency market cap to over 50% by 2026 (Figure 4).

Source: PlatoData Intelligence (bit.ly/3xXPK0r)