New materials, with the new international situation, has become a key segment for overcoming market challenges, and is favoured by national strategic development planning policies. Pearlescent materials and synthetic mica are high value-added new materials.

Global New Material (6616.HK), which carried out its IPO from June 30 to July 6 and plans to issue 290 million shares at HKD3.52-4.22 when it lists July 16, produces China’s market-leading shares in both.

Pearlescent materials have dominant advantages when compared with traditional pigments. As a new consumable material without a definite industry life cycle, pearlescent pigments are rapidly replacing traditional organic pigments and metal pigments, and are widely applied in coatings, inks, plastics, cosmetics, automobiles, aerospace and other fields. As set forth in the Classification of Strategic Emerging Industries (2018) issued by the central government, pearlescent materials are included in the pigment manufacturing sector of strategic emerging industries.

Global New Material, which stays focused on technology, plays a leading role in the field of pearlescent materials. With the strong support of the technical team, headed by Professor Jiansheng Fu, a world-renowned pearlescent material expert known as the leading authority on pearlescent materials in China, and father of chameleon pearlescent materials, Global New Material can launch over 100 new products every year, including silicon ball series, the Light of the Dawn series, and other innovative lines of products leading the global industry.

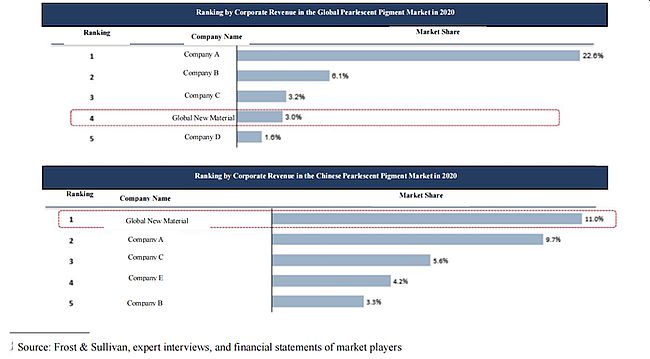

Global New Material has sold its products in China and to more than 30 countries and regions in Asia, Europe, Africa and South America. As shown in a report issued by Frost & Sullivan, in terms of corporate revenue, Global New Material was the largest manufacturer of pearlescent materials and the industry leader in China in 2020 with a market share of 11.0%, the only company in China that occupies a market share of over 10%.

In the global market, Global New Material ranked as the fourth largest manufacturer of pearlescent materials in 2020 with a market share of 3.0% which is only 0.2% lower than that of the third largest one. Global New Material is currently in the explosive stage of acquiring a market share of RMB140 billion.

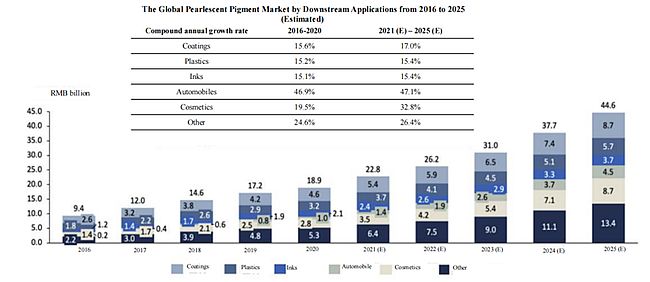

On the whole, the global pearlescent material market is on the steady rise with the market seize reaching RMB18.9 billion in 2020 and with a compound annual growth rate of 19.2% from 2016 to 2020. Considering that the total market size of the global pigment market is currently RMB160 billion, pearlescent pigments are expected to replace other pigments and gain a bigger market share.

As forecasted by Frost & Sullivan, in view of consumption upgrade and of the fact that pearlescent materials are gradually replacing other pigments, the market size of the pearlescent material market will reach RMB44.6 billion in 2025, and the compound annual growth rate of the global pearlescent pigment market will further climb to 23.9% from 2021 to 2025, indicating that the industry is in the explosive growth stage. (Chart #1)

In the mid-to-high-end consumer sector, the market share occupied by pearlescent materials is growing at an expedited pace.

According to data, the market size of automotive-grade pearlescent materials reached RMB950 million in 2020, accounting for 5.0% of the overall market size of the pearlescent materials market. In the field of cosmetics, the market size of cosmetic-grade pearlescent materials is also on the steady rise. Data shows that from 2021 to 2025, pearlescent materials to be applied in the global automotive market and the global cosmetics market will experience a compound growth rate of 47.1% and 32.8% respectively. (Chart #2)

In the consumer sectors, especially in the mid-to-high-end consumer sector, pearlescent materials that are gaining a greater market share will continue to drive the rapid development of Global New Material.

However, in addition to pearlescent materials, synthetic mica that is a new material extending to the upstream of the industrial chain and having core technical advantages is also giving strong support to the development of Global New Material.

From pearlescent materials to fuel cells, synthetic mica is of great market potential

Synthetic mica is widely applied in different fields, and is used as a base material of pearlescent materials. First-generation pearlescent materials are natural mica-based, and all-natural mica materials currently used are imported from India as natural mica in China has been exhausted. In this context, the best solution for achieving localization and avoiding reliance on imported technologies is to replace natural mica with synthetic mica.

Data shows that the market share of synthetic mica-based pearlescent pigments has increased from 5.3% in 2016 to 11.7% in 2020. Driven by the technology advancement and productivity improvement of synthetic mica, the market share of synthetic mica-based pearlescent pigments in the global market is expected to reach 23.6% in 2025, and the synthetic mica-based pearlescent pigment market will usher in a compound annual growth rate of 47.6% from 2021 to 2025.

Mica products are also widely used in producing insulating materials and refractory materials which are further used in electric power, high-temperature smelting, household appliances and other fields. In 2020, the market size of mica applied in producing pearlescent materials, in producing refractory materials, and in producing insulating materials reached RMB1.38 billion, RMB7.66 billion, and RMB3.70 billion respectively.

Moreover, synthetic mica products with better overall performance than natural mica products are still extending to higher-end markets, including the field of fuel cells that is the focus of the most attention in the market. Additionally, these materials can be further applied to semiconductors and other cutting-edge fields.

Given that synthetic mica-based products show better insulation, high-temperature resistance and corrosion resistance than natural mica-based products, synthetic mica-based products are more likely to be used in higher-end fields and broader applications. For example, synthetic mica-based products are widely used in producing cosmetic-grade and automotive-grade pearlescent pigment products, and in the thermal insulation material industry and even the fuel cell field of new energy vehicles.

Mica can be used as a high-temperature proton exchange membrane for fuel cells. Studies found that compared with graphene, which is developing as a proton-conducting material, mica performs better in terms of proton conductivity and thermal stability. At 150 degrees Celsius, mica membrane shows proton conductivity more than 2 times higher than that required for commercialization, which indicates that vehicles designed with fuel cells using mica membranes will have a greatly improved mileage.

At present, mica membrane as a new type of proton-conducting membrane material with high proton conductivity has taken shape in the research and development process. Studies found that the treated mica films show greatly improved proton conductivity and have their service temperature having been increased from 100 degrees Celsius to 500 degrees Celsius, and that the application of such films with high proton conductivity and excellent heat resistance in improving existing fuel cells will boost the development of the field of fuel cell vehicles.

Global New Material, which ranks first in the synthetic mica industry, is expected to be able to fully exploit the potential of this field. In 2015, the Ministry of Industry and Information Technology of the People’s Republic of China listed synthetic mica as one of the 18 key basic new materials for the national industrial upgrading project, and only CHESIR (now Global New Material) was authorized to take on this project.

As the only company in the industry that possesses all the core technologies of synthetic mica, Global New Material has effectively solved the key technical difficulties such as control instability, poor insulation performance, and hardness and brittleness caused by high fluorine content, and has realized the localization of the production of high-quality synthetic mica with the world-leading quality level of synthetic mica products. Besides, Global New Material is also expanding applications of synthetic mica.

Global New Material’s business scale is currently ranking first in the global industry.

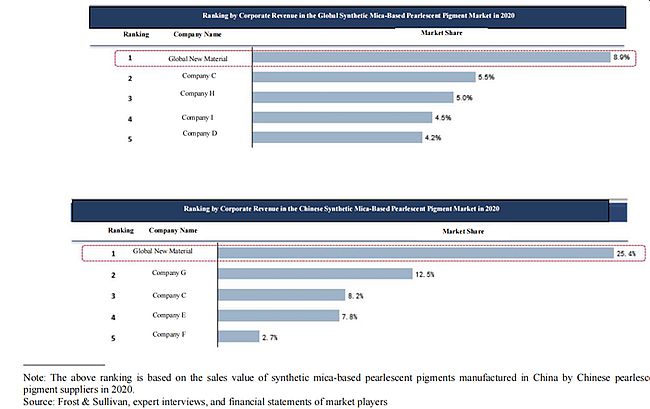

In the global synthetic mica-based pearlescent materials market, top five market players ranked by corporate revenue in 2020 occupied a total market share of 28.1%, and Global New Material ranked first with a market share of 8.9% which is 3.4% higher than that of the second one. In the domestic market, Global New Material ranked first with a market share of 25.4% which is more than twice the market share of 12.5% of the second player. (Chart #3)

With significant advantages in terms of technology and business scale, Global New Material will have immeasurable development prospects so long as it can commercialize synthetic mica in the field of fuel cells. As a leader in the global new material market which is gaining market share and has space for future development, Global New Material will appear in the secondary market at an attractive corporate valuation.

Global New Material still has an advantage in corporate valuation under the drive of two types of new consumable materials

Global New Material currently has a share capital of 1.163 billion shares at an issue price of HKD3.52-HKD4.22, with a total market value of HKD4.094 billion to HKD4.909 billion.

Global New Material had its net profit attributable to shareholders reaching RMB77.402 million, RMB103 million and RMB148 million respectively from 2018 to 2020, and had the net profit attributable to shareholders in 2019 and 2020 showing a year-on-year increase of 33.07% and 43.69% respectively. It is estimated based on those data that Global New Material’s price-to-earnings ratio will reach 15x-18x in 2021.

Ganfeng Lithium, a listed company on HKEx that is engaged in the upstream fields of the new energy battery, is expected to achieve a price-to-earnings ratio of about 64x in 2021, and Flat Glass Group, engaged in the industry of new energy photovoltaic glass materials, is expected to achieve a price-to-earnings ratio of 23x in 2021. This means that as an industry-leader possessing core technologies necessary for manufacturing two types of new consumable materials, Global New Material is of great potential to increase its corporate valuation.

Moreover, once its second-phase plant, with an annual output of 30,000-ton synthetic mica, is completed and put into operation, Global New Material will be able to take control of the upstream fields in the global supply chain of synthetic mica products, to take a leading position in the pearlescent material industry and the synthetic mica industry, and as a result, to further enhance its net profitability in the future.

Therefore, a wave of investment is expected to be triggered once Global New Material is officially listed on July 16.

Contact:

Haolu Wang, Peanutmedia

E: wanghaolu@czgmcn.com

URL: www.Peanutmedia.com