- The first of its kind Online Shopping Insurance protection by GCash, in partnership with Igloo, aims to offer peace of mind for 46 million GCash users when they transact using GCash

- Approximately 44% of digital consumers have been a target of a fraud scheme in Q1 2021

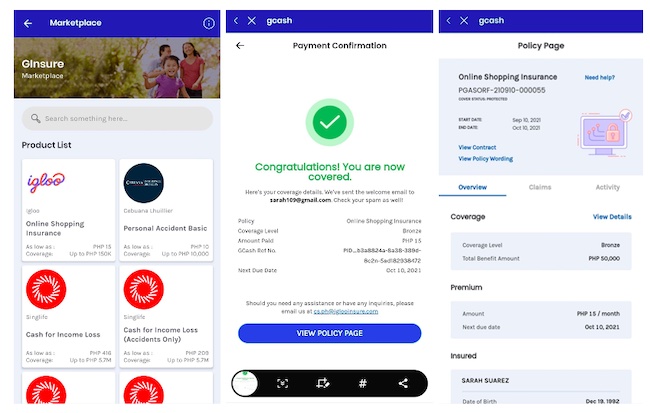

Philippines’ leading e-wallet provider GCash, has launched an online shopping insurance – underwritten by PGA Sompo – with Singapore-headquartered regional insurtech Igloo, to protect its growing online customer base. This launch and partnership come at a time where GCash has seen a surge in online transactions and is on track to hit PHP 3 trillion in full-year gross transactions – 3x of last year’s performance. This was driven by Filipino consumers shifting to online for their daily needs.

Today, there is an increasing demand to go cashless and more merchants and retailers are opting for the convenience of e-commerce, and express peer-to-peer cash transfers.

Over 70% of Southeast Asia is online and last year, the region saw 40 million new users join the internet. In a recent survey, the Philippines alone saw 37% of all digital service consumers are new to the service due to COVID-19. The survey also shows 97% of these new digital consumers will continue to use digital services going forward. This has led to an increasing need to be able to secure each transaction. Through this partnership with Igloo, GCash aims to provide peace of mind to its 46 million users while they shop online. The GCash app also had over 13 million log-ins per day, peaking at almost 15 million in the second quarter of 2021. This year, GCash aims to reach its PHP 3 trillion Gross Transaction Value (GTV) target and currently processes an average of PHP 300 billion in monthly transactions.

“This comes at an unprecedented time when we see robust growth in our online transactions and user base. With excellent customer experience being the heart of our business alongside value-added services through our platform, we are thrilled to launch this new product with Igloo that secures online transactions for our customers,” said Martha Sazon, GCash President and CEO.

“We are excited to partner with the leading e-wallet in the country, GCash – who shares the same vision of protecting digital consumers by pioneering innovative solutions to end-customers at an economical price. With the growing number of digital consumers in the country, now more than ever, is it most important to provide flexible solutions for the changing needs and processes of both businesses and customers. In a recent survey, 44% of the respondents had been a target of a fraud scheme. The majority of them, or 44% and 39% are experienced by Gen Z and Millennials, respectively. With many GCash customers belonging to this bracket, Igloo’s protection is not only timely but very relevant to GCash customers’ needs,” said Mario Berta, Igloo Philippines Country Manager.

The Online Shopping protection is one of the first products Igloo will be launching with GCash and its customers but will soon be rolling out more products with the e-wallet platform in the next six months that will be geared towards MSMEs which are about 90% of the businesses in the Philippines, securing the entire ecosystem of both seller-business owner-and-buyer.

Igloo’s Online Shopping product is part of its Cyber Protection vertical, which secures financial loss arising directly from any online marketplace fraud. With its pioneering partner, GCash – GCash users will now be protected from any transaction they make via online marketplaces such as Lazada, Shopee, including Viber and Facebook marketplaces as long as their payment was fulfilled via the GCash platform.

Since its entry into the Philippines with its collaboration with Southeast Asia’s largest and fastest-growing hotel management and booking platform, RedDoorz in 2019, Igloo has also partnered with the Union Bank of the Philippines in August last year and Philinsure early 2021. The insurtech has also widened its insurance partner base to include Mercantile, Pioneer, PGA-Sompo Insurance Corporation, and United Coconut Planters Life Assurance Corporation.

Images in high resolution are available for download here.

About Igloo

Igloo, previously known as “Axinan”, is the first full-stack insurtech firm to emerge from Singapore. It has offices in Singapore, Indonesia, Thailand, the Philippines, and Vietnam, and tech centres are located in China. With a mission of making insurance accessible for all, the firm leverages big data, real-time risk assessment, and end-to-end automated claims management to create B2B2C insurance solutions for platform companies and insurance companies. Igloo’s insurance solutions enable companies to eliminate their exposure to operational risk, create new revenue streams, and optimize and enhance existing products and services. In April 2020, Igloo successfully closed its Series A+ funding round worth US$8.2 million, bringing its total funding to US$16 million from global investors.

Igloo is led by a core team that comprises top talent from the technology and insurance industries hailing from global corporations including Facebook, Grab, Flipkart, Garena, Manulife, Shopee, Yahoo! and Zalora. For more information, please visit https://www.iglooinsure.com/

Media Queries

PRecious Communications for Igloo

igloo@preciouscomms.com