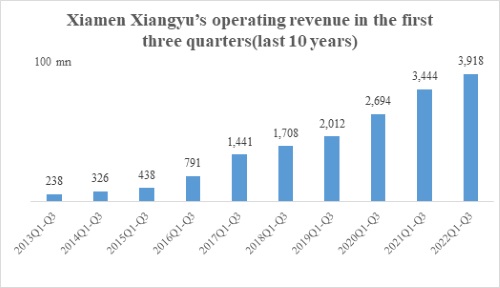

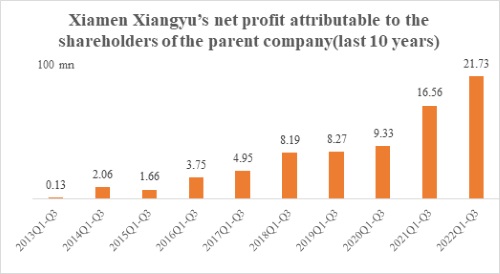

On the evening of Oct. 26, Xiamen Xiangyu Co., Ltd. (600057. SH) released the Q3 financial results. In the first three quarters of 2022, the Company achieved operating revenue of RMB 391.8 billion, with a year-on-year growth of 13.74%; achieved the net profit attributable to the shareholders of the parent company amounted to RMB 2.17 billion, with a year-on-year growth of 31.23%; achieved the return on equity of 15.26%, up 1.91 percentage points YoY. The Company’s operating revenue and net profit attributable to the shareholders of the parent company both hit a record high in the same period, and the operating efficiency continued to improve.

Xiamen Xiangyu is the leading commodity supply chain service company in China, with manufacturing enterprises in China as the main target group, and is committed to providing tailored supply chain solutions and one-stop services, including commodity procurement distribution, logistics, supply chain finance, information consulting, etc., to reduce circulation costs, improve circulation efficiency, assist manufacturing enterprises in cost-saving and profit-increasing, and earn service revenue. Xiamen Xiangyu has been operating commodities covering metals and minerals, agricultural products, energy and chemicals, new energy products, etc., and the key categories are ranked among the top in the industry. At present, the Company has taken the lead in the industry to build up a network for logistics service systems with “road transportation, rail transportation, water transportation and warehousing” as the core, covering the whole country and connecting with overseas, constructing a differentiated competitive edge.

In the first three quarters of 2022, the recurrence of the COVID-19 epidemic, geopolitical tensions, and commodity price shocks put higher requirements on the management and risk control capabilities of commodity supply chain companies. Xiamen Xiangyu said, in the face of multiple challenges, the Company maintained strategic stability, continuously optimized customer structure, enriched the commodity portfolio, consolidated logistics support, improved the risk control system, moreover, effectively responded to industry cycle fluctuations and external risk issues; on this basis, we seized the opportunity to expand market share and explore business opportunities to ensure that the overall operation remains sound.

According to the third quarter financial report, the service volume for manufacturing enterprises in Xiamen Xiangyu accounted for more than 50%, and the bulk commodity business segment in the cargo volume reached 141 million tons. The supply chain operating results in categories such as aluminum, new energy products, and soybeans achieved significant growth, among which the revenue of the new energy products supply chain reached RMB 14.7 billion, up 151% YoY; achieved the gross profit RMB 385 million, up 245% YoY.

In recent years, Xiamen Xiangyu has been favored by more and more investment institutions with its complete business system, steady pace of development, and promising prospects. In the first half of 2022, Xiamen Xiangyu was held by five mainland social security funds at the same time, making it one of the most popular listed companies favored by social security funds in the A-share market.

Looking ahead, Xiamen Xiangyu will anchor the strategic vision of “Becoming A World-class Supply Chain Service Company”, continue to optimize the customer structure, commodity portfolio, business model, and profit model, enhance the risk control system, improve the level of comprehensive income, and strive to exceed the 2022 annual operating target.

Click here for the full report: Xiamen Xiangyu Co., Ltd. Report for Third Quarter of 2022

http://www.sse.com.cn/disclosure/listedinfo/announcement/c/new/2022-10-27/600057_20221027_3_QazgirXb.pdf