The latest Advertising Association/WARC Expenditure Report, published today, shows that the UK’s ad market recorded a 6.1% increase in investment to a total of £36.6bn in 2023; the 13th annual expansion recorded in the last 14 years. The new survey data also shows that online formats now account for over three-quarters of all UK ad spend for the first time.

New AA/WARC forecasts show advertising spend will rise by 5.8% to reach £38.8bn this year, though this represents a minor (-0.1pp) downgrade from January’s forecast owing to prolonged inflationary pressures on the market. Further growth – of 4.5% – is expected in 2025, by when the UK’s ad market will be worth more than £40bn.

When compared to Europe’s largest advertising markets, the UK’s advertising industry was seen to have outpaced Germany (-0.7%), France (+2.1%) and Ireland (+3.0%) last year, and is expected to repeat this in 2024. The UK’s ad market is on course to end the year some $20bn larger than those of its closest neighbours.

The full picture in 2023

While UK ad spend grew by 6.1% last year, this equated to a 1.2% contraction in real terms after accounting for high inflation, a rate which slightly lagged the flat (+0.1%) activity witnessed across the UK’s economy last year.

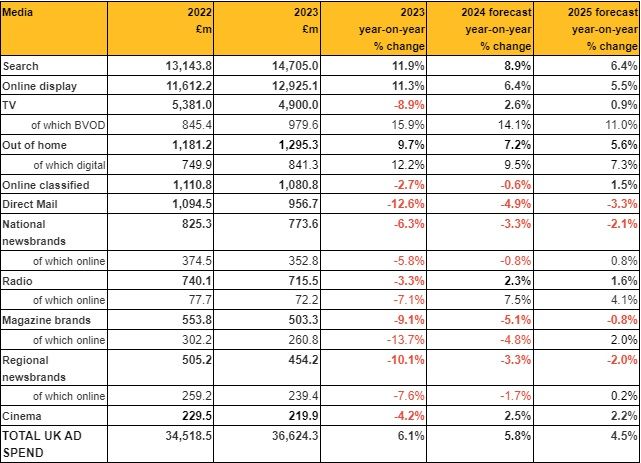

As estimated in January, online formats combined grew by 11% to reach a total of £28.7bn in 2023, equivalent to 78.4% of all UK ad spend last year. Beyond this, out of home (+9.7%) was the only other advertising medium to record growth in 2023.

The only major product sectors to record rising display ad spend (i.e. excluding search and classified formats) last year were retail (+5.0%) and services (+4.7%), the latter almost entirely attributable to a 6.6% rise in the entertainment & leisure sector.

The latest AA/WARC data also reveals actual investment for last year’s Q4 Christmas ad season, which topped £9.7bn after achieving growth of 7.4% year-on-year. This growth was led by digital out-of-home (+18.1%) and BVOD (+15.9%) as well as search (+12.9%), as the traditional uplift in Golden Quarter investment was buoyed further by increased advertising activity during the Rugby World Cup.

Projections for 2024 and 2025

The latest AA/WARC dataset expects the UK advertising market to grow 5.8% to reach nearly £39bn in 2024. Broadcast media, most notably TV (+2.6%) and radio (+2.3%) are expected to return to growth, while the same is true for cinema (+2.5%). Among digital formats, search (+8.9%) and online display (+6.4%) are again set to see the strongest rises, closing the year with a combined share of 77% of all spend.

More favourable economic conditions should encourage advertisers to invest more in brand-building campaigns in 2024 and this, coupled with short-term stimuli such as the Men’s Euros in June, the upcoming General Election in the second half of the year and, to a lesser extent, the Paris Olympics in July, are expected to contribute to healthy growth in formats such as broadcaster video-on-demand (+14.1%) this year.

The picture is set to improve further for more channels in 2025 as a rise of 4.5% is forecast for the market as a whole. This includes an 11% rise for BVOD, 6.4% for search and 5.5% for online display, as economic headwinds are anticipated to ease.

Stephen Woodford, Chief Executive, Advertising Association said: “The continued shift to online advertising formats reflects the changing shape of our economy, with people increasingly shopping online as well as on the high street, and businesses striving to provide the best customer experience in all scenarios. The UK advertising industry is much respected around the world, which is why we continue to see the exports of UK advertising services grow, an important source of additional revenue for many advertising businesses in a domestic economy that has little-to-no growth.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC said: “Our latest survey of media owners confirms 2023 as a challenging year for most, with few properties recording gains and spend instead further consolidating within search and online display formats – particularly social media. Combined, these digital staples are on course to account for almost four in five pounds spent on advertising in the UK next year, up from a share of 51% just five years ago.

“Our forecasts assume that the UK’s economy will begin to break from the pattern of stagnation that has come to define recent quarters. Easing inflation over the coming 18 months should encourage more favourable trading conditions within the advertising sector, facilitating growth across a broader range of channels in turn.”

The quarterly Advertising Association/WARC Expenditure Report is the definitive guide to advertising expenditure in the UK, with data for all key advertising media and sub formats dating back to 1982 and forecasts spanning eight quarters ahead.

Full data analysis of the latest figures is available to AA/WARC Expenditure report subscribers on the AA/WARC ad spend hub.

For further information, please contact:

WARC

Amanda Benfell

Head of PR & Press, WARC

amanda.benfell@warc.com

www.warc.com

Advertising Association

Matt Bourn

Director of Communications

Matt.Bourn@adassoc.org.uk

Mariella Brown

Communications Manager

Mariella.Brown@adassoc.org.uk

About the Advertising Association/WARC Expenditure Report

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK. Impartial and independent of any media channel or agency affiliation, it is the only source of historical quarterly adspend data and forecasts for the different media for the coming eight quarters. With data from 1982, this comprehensive and detailed review of advertising spend includes the AA/WARC’s own quarterly survey of all national newspapers, regional newspaper data collated in conjunction with Local Media Works and magazine statistics from WARC’s own panels. Data for other media channels are compiled in conjunction with UK industry trade bodies and organisations, notably the Internet Advertising Bureau, Outsmart, Radiocentre and the Royal Mail.

All data are net of discounts and include agency commission, but exclude production costs. The survey was launched in 1981 and has produced data on a quarterly basis ever since.

Methodology for WARC’s quarterly forecasts

Analysis of annual adspend data over the past 35 years shows that there is a link between annual changes in GDP and annual changes in adspend (after allowing for inflation, and excluding recruitment adspend). Over this period, GDP changes account for about two thirds of the change in adspend. WARC has developed its own forecasting model to generate forecasts for two years based on assumptions about future economic growth. The model provides an indication of likely overall spend levels – adjusted to allow for short-term factors (Olympics, World Cup etc).

The Expenditure Report (www.warc.com/expenditurereport) launched online in February 2010 and combines data from the discontinued print publications the Quarterly Survey of Advertising Expenditure and the Advertising Forecast. It is relied upon daily by the world’s largest brands, ad agencies, media owners, investment banks and academic institutions. Alongside over 200 readymade tables, subscribers can create their own customised tables for analysis of different media and time periods, as well as track the different media’s share of adspend. All reports can be exported from the online interface. An annual subscription is priced at £760 for AA members and £1,175 for non-members.

About the Advertising Association

The Advertising Association promotes the role and rights of responsible advertising and its value to people, society, businesses, and the economy. Responsible businesses understand that there is little point in an advertisement that people cannot trust. That’s why, over 50 years ago, the Advertising Association led UK advertising towards a system of independent self-regulation which has since been adopted around the world. There are nearly thirty UK trade associations representing advertising, media, and marketing. Through the Advertising Association they come together with a single voice when speaking to policy makers and influencers.

About WARC – The global authority on marketing effectiveness

For over 35 years WARC has been powering the marketing segment by providing rigorous and unbiased evidence, expertise and guidance to make marketers more effective. Across four platforms – WARC Strategy, WARC Creative, WARC Media, WARC Digital Commerce – its services include 100,000+ case studies, best practice guides, research papers, special reports, advertising trend data, news & opinion articles, as well as awards, events and advisory services. WARC operates out of London, New York, Singapore and Shanghai, servicing a community of over 75,000 marketers in more than 1,300 companies across 100+ markets and collaborates with 50+ industry partners.

WARC is part of Ascential plc.