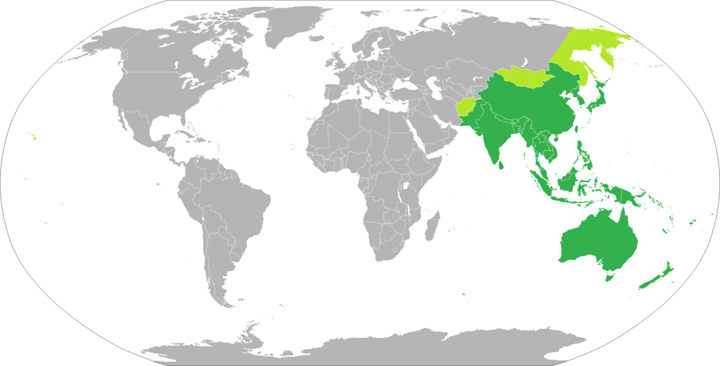

A recent report released by Frost & Sullivan Asia Pacific showed that the volume of foreign direct investments in the Asia-Pacific region contributes about 20-25% of the overall global deal volumes.

Investments in the Asia-Pacific region since 2010 were focused on the materials sector, which included diversified metals and mining, the report said.

Globally, investments in the ICT, energy and healthcare sectors topped the list during the period.

Asia-Pacific, however, counts as key sector for growth the Internet-linked businesses, media, semiconductors, telecom, media, technologies, among others.

Sanjay Singh, Frost & Sullivan Asia Pacific vice president for business and financial services, said Asia-Pacific will remain highly relevant for the global investor community, especially with the increasing availability of market capital and investor opportunities across different sectors.

“The outlook for Indonesia is especially exciting for us, as a high-growth investment landscape, with of course China being the leader in deal activity for the region,” Singh said.

China was the most active region in the world and accounted for 32 per cent of total deals in the Asia-Pacific region.

About 95 per cent of these deals were from domestic acquirers, indicating a trend of industry consolidation within China.