International Energy Group achieves net profit of US$1.8 million for first nine months of FY2017, reversing loss of US$0.2 million a year earlier

SINGAPORE — New Silkroutes Group Limited (“NSG” or the “Group”) has raised its revenue forecast for oil trading by 29% to US$400 million for its current financial year ending 30 June 2017 (“FY2017”), following another quarter of strong performance by its wholly-owned International Energy Group Pte Ltd (“IEG”).

Summary of Results: http://bit.ly/2qlDZRL

The last time NSG had annual revenue of at least US$400 million was 14 years ago in FY2003, when it was distributing consumer IT products across Asia. The Group, which is no longer in the distribution business, is now an investment holding company focused on energy trading, healthcare management, real estate investment and fund management.

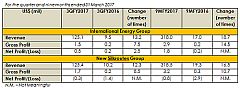

Singapore-headquartered IEG, which trades primarily crude components and distillates, generated revenue of US$125.1 million in its fiscal third quarter ended 31 March 2017 (“3QFY2017”), its best quarterly performance since it commenced operations in June 2015.

IEG, whose counterparties include oil supermajors and national oil companies, had revenue of US$9.5 million in the same period last year (“3QFY2016”) and US$123.7 million in the second quarter ended 31 December 2016 (“2QFY2017”).

The improved performance, driven by increased transactions and trading volumes, lifted IEG’s revenue for the first nine months of FY2017 to US$318.0 million. This surpasses its previous revenue forecast of US$310 million set in November last year for the whole of FY2017. It is also well above IEG’s revenue of US$49.6 million for all of FY2016.

With the higher revenue, IEG turned in a net profit of US$527,189 in 3QFY2017, more than double its earnings of US$210,492 in 3QFY2016. It had a net profit of US$664,638 in 2QFY2017. For the first nine months of FY2017, IEG attained a net profit of US$1.8 million, reversing a net loss of US$201,146 for the same period a year earlier.

Mr Artun Gursel, IEG’s book leader and trading manager, said: “IEG has delivered exponential growth in the two short years that it has been in business, despite the global slump in oil prices. We have been able to do so by staying nimble, working with reliable counterparties, and taking calculated risks without biting off more than we can chew.”

To drive growth further, IEG will seek to expand its portfolio of trading products, which will include crude oil, and invest in assets such as storage facilities or distribution networks, he added.

IEG’s performance lifted NSG’s revenue for 3QFY2017 to US$125.4 million from US$10.2 million a year earlier. For the first nine months of FY2017, NSG’s revenue came in at US$318.5 million, up from US$19.3 million for the same period in FY2016.

As part of efforts to diversify its income stream, NSG formed a joint venture in March this year to provide real estate advisory, deal origination and investment structuring services to investors eyeing property markets in the world’s three largest economies and several other Asian markets.

A month earlier, on 3 February 2017, NSG offered to acquire an 80% stake in CG Capital Markets Holdings LLC, a New York-based broker-dealer and investment bank, in a move that will enable it to offer various financial services, including capital raising and fixed-income market making, to companies worldwide.