Both PBT and PAT increased by 114.8% and 116.5% respectively as compared to Q3FY16. The Company is newly listed on Bursa Malaysia as the largest IPO by Market Capitalisation since May 2015.

KUALA LUMPUR — Serba Dinamik Holdings Berhad (“Serba Dinamik Holdings” or the “Company”), is a recent debut on the Main Market of Bursa Malaysia on 08 February 2017. The Company’s Initial Public Offerings (“IPO”) is also known as the largest IPO by market capitalisation since May 2015. Serba Dinamik Holdings, together with its subsidiaries (“Group”), an energy engineering services provider to the oil and gas (“O&G”) and power generation industries, with operations locally and overseas, recently announced its financial results for the fourth quarter ended 31 December 2016 (“Q4FY16”).

Q4FY16 vs Third quarter ended 30 September 2016 (“Q3FY16”)

– An increase of 43.1% in revenue at RM731.77 million as compared to RM511.51 million recorded for the preceding quarter – The improvement in revenue was mainly driven by the Group’s operations & maintenance (“O&M”) segment with a contribution of 86.5%, followed by its engineering, procurement, construction and commissioning (“EPCC”) segment that contributed 13.5% to the Group’s total revenue.

– A significant increase in Profit Before Tax (“PBT”) at RM103.92 million and Profit After Tax (“PAT”) at RM96.70 million for Q4FY16. Both PBT and PAT recorded growth rates of 114.8% and 116.5% respectively as compared to RM48.38 million and RM44.66 million correspondingly documented for Q3FY16.

Financial Year Ended 2016 (“FYE 2016”) vs Financial Year Ended 2015 (“FYE 2015”)

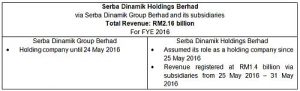

– The Company assumed its role as a holding company since 25 May 2016. For the full financial year ended 31 December 2016, Serba Dinamik Holdings registered RM2.16 billion in revenue. The explanation is as listed below:

Image: https://www.acnnewswire.com/topimg/Low_serba1703081.jpg

– A total revenue of RM2.16 billion for FYE 2016, an increase by 53.6% as compared to RM1.40 billion posted for FYE 2015. Subsequently;

– PAT increased by 61.32% at RM252.57 million as compared to RM156.56 million recorded the preceding financial year.

Group Managing Director / Group Chief Executive Director of Serba Dinamik Holdings, Dato’ Dr. Ir. Mohd. Abdul Karim bin Abdullah (“Dato’ Karim”) expressed, “We are very pleased with our performance over the year, which has been proven with the significant growth in the Group’s results. Our revenue was mainly derived from foreign operations whereby our Middle East*[1] operations contributed to 51.5% of our total revenue for the period under review. Our local operations remained the largest contributing country, which saw contribution of 35.4% to our revenue, generated from our local contracts. Accordingly, it is one of our future plans upon listing to upgrade the existing logistics centre in Ras Al Khaimah, United Arab Emirates.”

Serba Dinamik Holdings recently, through its wholly-owned subsidiary, Serba Dinamik Sdn. Bhd. (“SDSB”) entered into a Share Purchase Agreement (“SPA”) for the acquisition of 40% of the total issued share capital of Konsortium Amanie Joint Venture (“KAJV”) for a total consideration of RM34.0 million. Additionally, SDSB entered into a sale of shares agreement for the acquisition of 100% equity interest in Supreme Vita Industries Sdn Bhd, which is expected to be completed by the third quarter of 2017, following the last instalment of the balance total. Through this acquisition, the Group was granted an EPCC contract worth RM289.7 million as well as a 40% share of KAJV’s profits generated from a RM 1.3 billion value contract awarded to KAJV by the state government of Terengganu on 28 April 2016.

Dato’ Karim added, “We are optimistic that we can further strengthen the Group’s business viability and profitability, as we believe that our recent acquisitions will be able to generate recurring income stream for the sustainability of the Group. In line with the expansion of our asset ownership business model, we currently have two ongoing MoUs for the partnership agreement of developing of small gas power plants and water utilities in East Kalimantan with the local government district development body, and the joint development and ownership of a small gas power plant in Muaro Jambi, Sumatra, Indonesia with a local government-owned power corporation. We are also looking at opportunities to grow our business through investment and acquisition, but not limited to MRO service providers and small hydropower generation companies that can potentially add value to our existing business operations while enhancing our competitive advantages within the industry.”

Dato’ Karim further expressed, “Collectively, we have more than 800 employees in Malaysia, Indonesia, Brunei, Bahrain and United Kingdom’s operations as to date. Our established track record is supported by the achievement of numerous awards for the recognition of the Group’s outstanding performance, as presented by both national and international bodies such as PETRONAS Carigali Sdn Bhd, The European, the Ministry of International Trade and Industry and The Brand Laureate. Additionally, one of our subsidiaries, Serba Dinamik IT received MSC Malaysia status in 2011 for the research, development and commercialisation of our in-house developed proprietary software, namely, AlignSoft and myPlant.”

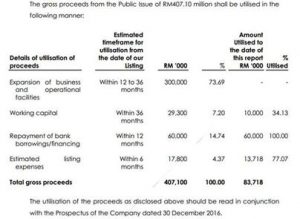

To date, upon the Company’s listing on 8 February 2017, Serba Dinamik Holdings has utilised its IPO proceeds in the manner as listed below:

Image: https://www.acnnewswire.com/topimg/Low_serba1703082.jpg

Footnote:

[1] Middle East is inclusive of Qatar, Kuwait, United Arab Emirates, Kingdom of Saudi Arabia, Oman and Bahrain (In reference to page 14 of the Company’s announcement)