The board of directors decided to issue a dividend of NT$12 per share, equating to a 78% dividend yield

TAIPEI – (ACN Newswire) – Chlitina Holding (“Chlitina”, ticker:4137 TT) held a board meeting on Mar 12, to discuss the company’s operating achievements and dividend policy of 2018.

Summary:

– In 2018, Chlitina reported consolidated sales of NT$4.58 billion, a net profit after tax of NT$1.22 billion, and achieved after-tax earnings per share (EPS) of NT$15.4. Both consolidated sales and profit numbers broke historical records.

– Benefitting from the emergence of scale effect of our core business, “CHLITINA”, the beauty salon franchise, Chlitina’s sales increased nearly 40% in 2018; In terms of marketing, we strategically allocated resources to various campaigns, which boosted our brand image and value, as well as promoted the strong sales growth of our “Xinmeili e-commerce platform” and “UPLIDER Medical Beauty Clinic”. The annual growth rate increased by multiples.

– Chlitina Group stabilized its leading position in the beauty industry by utilizing three main channels, stimulating the company’s operating profit ratio to 34.13%. Combined with improvements in management, cost control and additional allowances from outside ventures, the company successfully broke historical records this year.

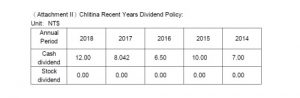

– Chlitina’s board members voted to pass the dividend policy proposal. Considering the company’s robust financial structure and abundant cash flow, we decided to distribute a NT$12 cash dividend, equating to a 78% dividend payout rate, to reward our shareholders. The dividend yield amounts to 4.29%, using the closing price NT$279.5 on March 12, 2019.

– Looking forward to the first quarter of 2019, we anticipate high demand within the Chinese beauty industry and a clear path for growth. Thus, we expect continuous sales growth in individual Chlitina stores. Chlitina Group is actively seeking to fill a gap in the Chinese beauty market through precise marketing campaigns, effective management strategies, etc. Observing the growth of our franchise stores, we are optimistic about our target of adding 400-500 stores to our net count this year. We expect to create a cornerstone of stable profit growth with the help of the continuous expansion of the single store operation scale.

Looking back at operation results in 2018:

Chlitina Holding reported consolidated sales of NT$4.58billion, NT$1.22billion after tax, and achieved NT$15.4 earnings per share, amounting to 39.13%, 109.08%, 107.83% YoY growth respectively. Both consolidated sales and profit levels broke the historical record.

Chlitina Holding explained that the company’s outstanding operation performance benefited from its core business, “CHLITINA”, the beauty salon franchise accounts up to 96% of the company’s total revenue, which reached a YoY 40% increase in consolidated sales in 2018. Since the beginning of the year, Chlitina has focused on strengthening its brand influence and providing comprehensive training classes for franchisees. With successful investment policies and efficient management, we increased the number of franchisees to 4,479 globally, a 15% increase from last year. Due to the increasing number of franchisees and resulting scale effect, we enjoyed steady operation growth in 2018.

In terms of marketing strategies, we efficiently allocated resources to various promotional campaigns, boosting our brand image and value. Meanwhile, we promoted our UPLIDER Medical Beauty Clinic and Xinmeili e-commerce platform, which each achieved multiples of yearly sales growth. The Xinmeili e-commerce platform achieved a YoY 101% increase in revenue (calculated in RMB), significantly contributing to the company’s over 1 billion RMB annual revenue and a YOY 38% increase. Chlitina Holding stabilized its leading position in the beauty industry by utilizing its three major channels, stimulating the company’s operating profit ratio to 34.13% in 2018, 10% higher than that of 2017. Combined with management optimizations, cost reductions and allowances from outside ventures, the company successfully broke historical records this year.

Chlitina board members voted to pass the dividend policy proposal. Considering the company’s healthy financial structure and abundant cash flow, we decided to distribute a NT$12 cash dividend, equating to a 78% dividend payout rate, to reward our shareholders. The dividend yield amounts to 4.29%, using the closing price NT$279.5 on March 12, 2019.

2019 Q1 operation outlook:

Looking to the first quarter of 2019, we expect high demand within the Chinese beauty industry and a clear path for growth. Thus, we anticipate continuous sales growth in individual Chlitina stores. Chlitina Holding is actively seeking to fill a gap in the Chinese beauty market through precise marketing campaigns, effective management strategies, etc. On the one hand, we rely on social media (Weibo) to jointly promote different brands. One the other hand, we offer precision skin care testing experiences at our physical stores. Through the successful fusion of on- and offline efforts, the number of franchised Chlitina locations by the end of February showed a net increase of 68 stores, compared to that of December 2018. The combined revenue in first two months of 2019 has gained an approximately YoY 10% growth. Observing the growth of our franchise stores, along with cost controls and additional financial assistance, we are optimistic about our target of adding 400-500 stores to our net count this year. This, in turn, should create a cornerstone of stable growth for the company.

According to beauty salon brand awareness market research conducted by a Shanghai market survey company, Chlitina enjoys much higher brand awareness and acceptance among consumers compared to other brands in 2018. Preference for Chlitina is close to 50%, illustrating our success in branding. In recent years, Chlitina has extended into areas of e-commerce, cosmetic surgery and dermatology, which has helped build our “beauty industry chain”. Meanwhile, we continue to improve efficiencies in corporate governance, our supply chain, accounting practices, human resources and other aspects of internal management to ensure Chlitina Group’s longer-term sustainability and to contribute to the company’s future planning.

About Chlitina

Chlitina was founded by Dr. W.K. Chen in 1989. In 1997, Chairman Chen Pi-hua extended Chlitina to the Mainland China market and went public in Taiwan in 2013. The business is now located in mainland China, Taiwan and Hong Kong, and looking to expand in Southeast Asia. Chlitina has more than 4,500 franchised shops globally; of them, more than 4,200 shops operated in mainland China. It has trained more than 300,000 professional beauty consultants and become a symbolic Chinese beauty salon chain brand.

Dr. W.K. Chen, founder of Chlitina, is known as the Father of Amino Acid. He is the first medical beauty expert to apply amino acids in skincare. Since then, Chlitina products have become skincare leaders for their fantastic results. Chlitina has formed three kinds of treatments in 22 series of mature skincare systems with the professional skincare philosophy of “Medicine-Based Beauty”. Its products have become skincare leaders for their obvious results, which include gently caring for & revitalizing skin.

Chlitina Official Website: www.chlitina.com

Disclaimer:

Some of the statements contained in this press release may be considered forward-looking statements. These statements identify prospective information. Forward-looking statements are based on information available at the time and/or management’s good faith belief with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. These forward-looking statements are subject to a number of factors that may cause actual results to differ materially from the expectations described, which include but are not limited to economic, competitive, market, currency, governmental and financial factors. Chlitina Holding assumes no obligation to update forward-looking statements to reflect actual results, changes in assumptions.